As part of the bulk change process to GoCardless, you'll need to use our bulk change import tool to upload details of your existing customers' ACH Debit Authorizations (also known as Consumer Authorizations) into the GoCardless dashboard.

There are 10 steps you'll need to follow.

Step 1. Make sure you're using one of Chrome, Firefox, or IE 9+ as your internet browser

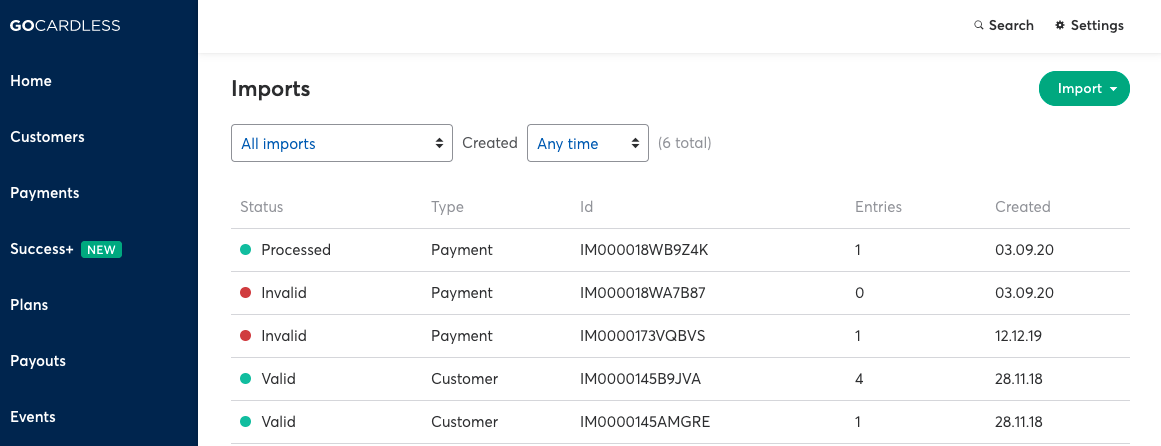

Step 2. Login to your GoCardless account via this link to open your Imports area

Alternatively, type 'manage.gocardless.com/imports' into your address bar and hit Enter

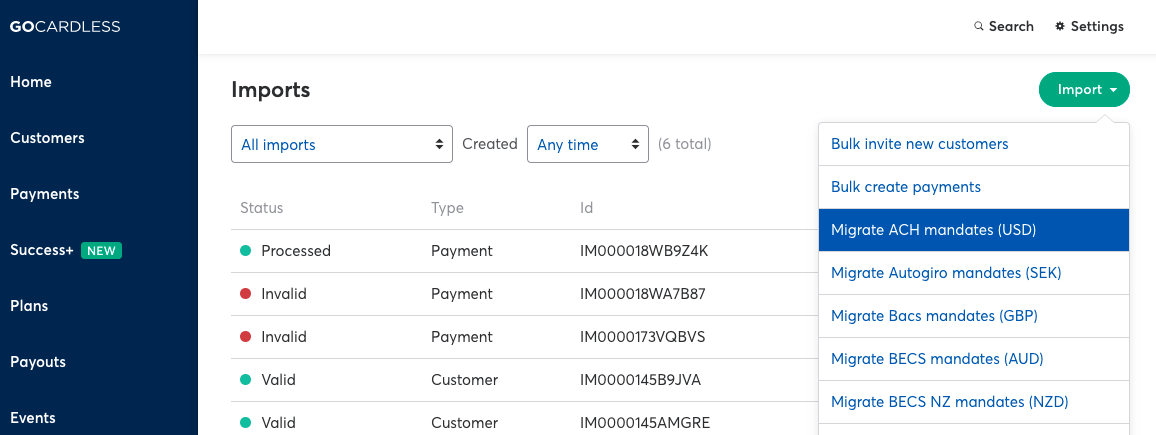

Step 3. Click the Import button in the top right and select Migrate ACH mandates (USD)

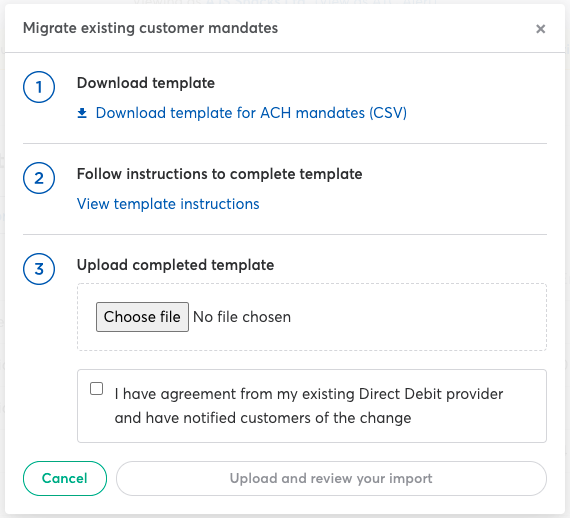

Step 4. In the window that opens, click Download template for ACH mandates (CSV)

Step 5. Convert the CSV spreadsheet into 'Text' format within Excel. To do this:

a). Click the arrow in the top left of the spreadsheet to select all cells

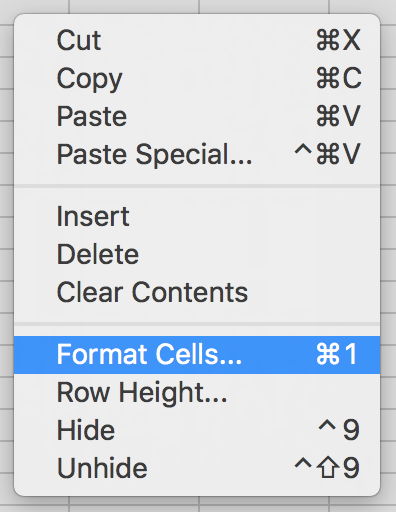

b). Right-click anywhere within the selected area and select Format Cells

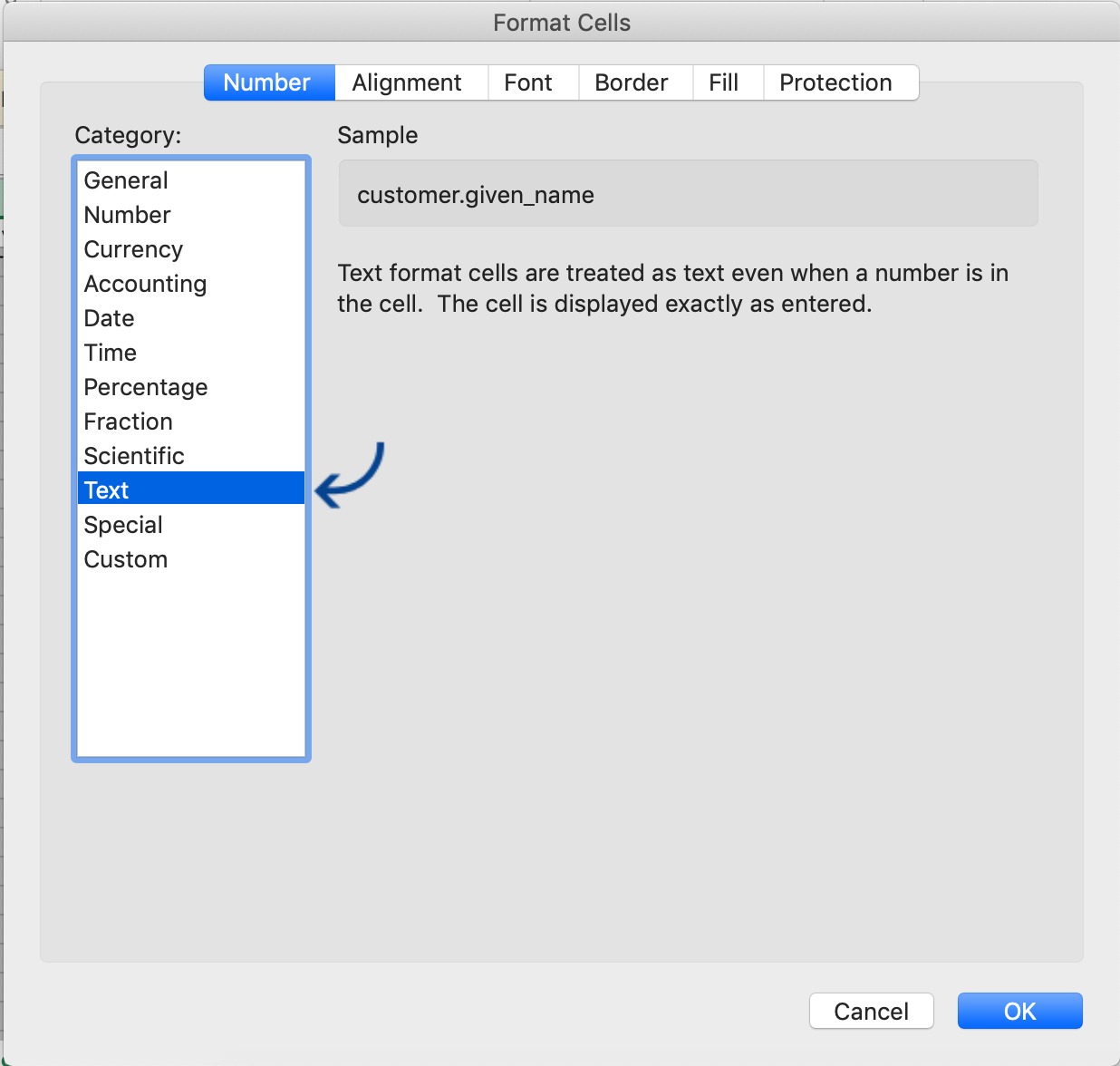

c). Select Text from the options in the left column and hit OK

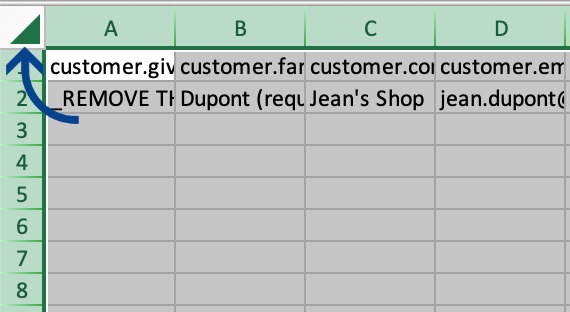

Step 6. Add your customers' data to the CSV template, making sure to add it correctly

NOTE: You will need to delete the example data row in the CSV before uploading the template. You can do this by selecting the full row, right-clicking, and selecting 'delete'.

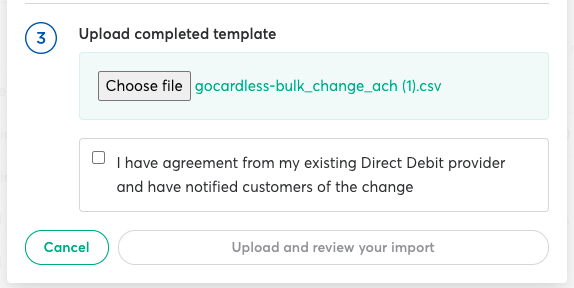

Step 7. Upload the template via step 3 in the Migrate existing customer mandates window

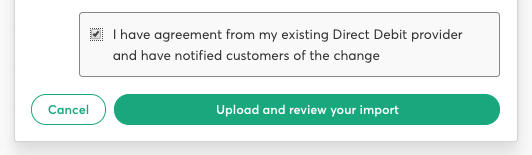

Step 8. Tick the box to confirm that you have agreed the bulk change with your existing ACH Debit provider and have notified your customers of the change. Click Upload and review your import to proceed.

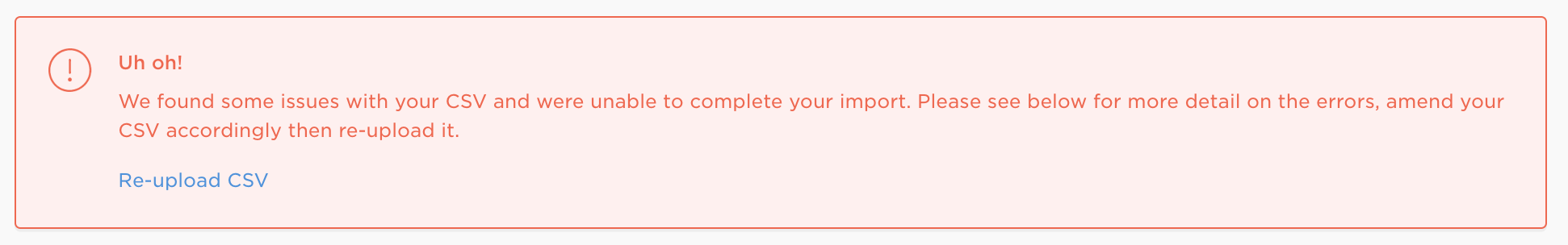

Step 9. Your CSV data will then run through a short validation process. If there are any errors, you will be advised as per the following notice.

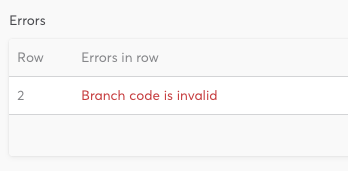

You'll be shown details of the error(s) and where to find them below.

Once you have corrected the errors, save your CSV file and retry the upload.

Step 10. Let us know once you've completed the upload process, and we'll contact you with next steps.

How to enter your customers' bulk change data

To avoid errors, make sure you complete the CSV template according to the requirements in the table below.

Some fields in the example row in the CSV include "(required)" after the information entered into that cell. This is just for example purposes but is used to identify the field as mandatory when entering customer information.

Data fields and examples:

| COLUMN | DATA | EXAMPLE |

|---|---|---|

| A | customer.given_name | John |

| B | customer.family_name | Smith |

| C | customer.company_name | John's Gyms Ltd |

| D | customer.email | john.smith@example.com |

| E | customer.language | en |

| F | customer.address_line1 | 1600 Pennsylvania Ave NW |

| G | customer.city | Washington |

| H | customer.region (State code) | DC |

| I | customer.postal_code (ZIP code) | 20500 |

| J | customer.country_code | US |

| K | bank_account.account_holder_name | John Smith |

| L | bank_account.account_number | 2715500356 |

| M | bank_account.bank_code (Routing Code) | 026073150 |

| N | bank_account.account_type (Saving/Checking) | Checking |

| O | mandate.payer_ip_address | 8.8.8.8 |

| P | customer.metadata.custom_reference | WIL12251 |

Additional information:

| COLUMN | INFORMATION |

|---|---|

| A, B, C |

Enter either customer given name + surname OR company name. If your previous provider exported your customers' full names in a single cell per whole name, rather than splitting between given name and family name, you can use the text to columns function in Excel to separate. |

| D | A valid email address is required for each customer so that they receive notifications from GoCardless about their payments. If you are planning to send your own notifications to your customers, please speak with your Account Executive. |

| E |

This will determine the language of customer notifications. |

| F,G,H,I,J |

The customer's address must be stored against their ACH Debit Authorization. |

| K |

This is separate to the 'name' entry fields, since account holder name can differ from the individual (e.g., it could include a middle name) or company name. |

| L |

10-12 digit account number. A USD enabled bank account must be used for ACH Debit payments. |

| M | 9-digit routing number. |

| N | Checking or Saving account type. |

| O | (Recommended) The IP address of the customer at the point that their ACH Debit Authorization was set up. Used as evidence to dispute potential unauthorized return claims. |

| P | (Optional) - Use this field to add a custom reference for your customer if required. This will be assigned to your customer within your dashboard and is a searchable field. |