Whether you've integrated directly with our API or have chosen to use our online dashboard, with GoCardless you can collect payments from your international customers just as easily as those based in the same country as you.

Key product benefits:

A simple way to collect international payments

- It’s easy to set up, and you can get started using your existing bank account

- Faster and safer access to customers from 30+ countries*

- Our expanding network currently supports USD, GBP, CAD, DKK, SEK, NZD, AUD, EUR.

Transparent pricing

- Our pricing covers payment automation, global settlement & foreign exchange. See transaction fees based on business location.

- No additional“cross-border” or “currency conversion” fees, unlike other payment providers.

Fairest exchange rate

- We offer the real exchange rate as provided by TransferWise – it is the fairest exchange rate of the trade

- We don’t add a margin to the exchange rate

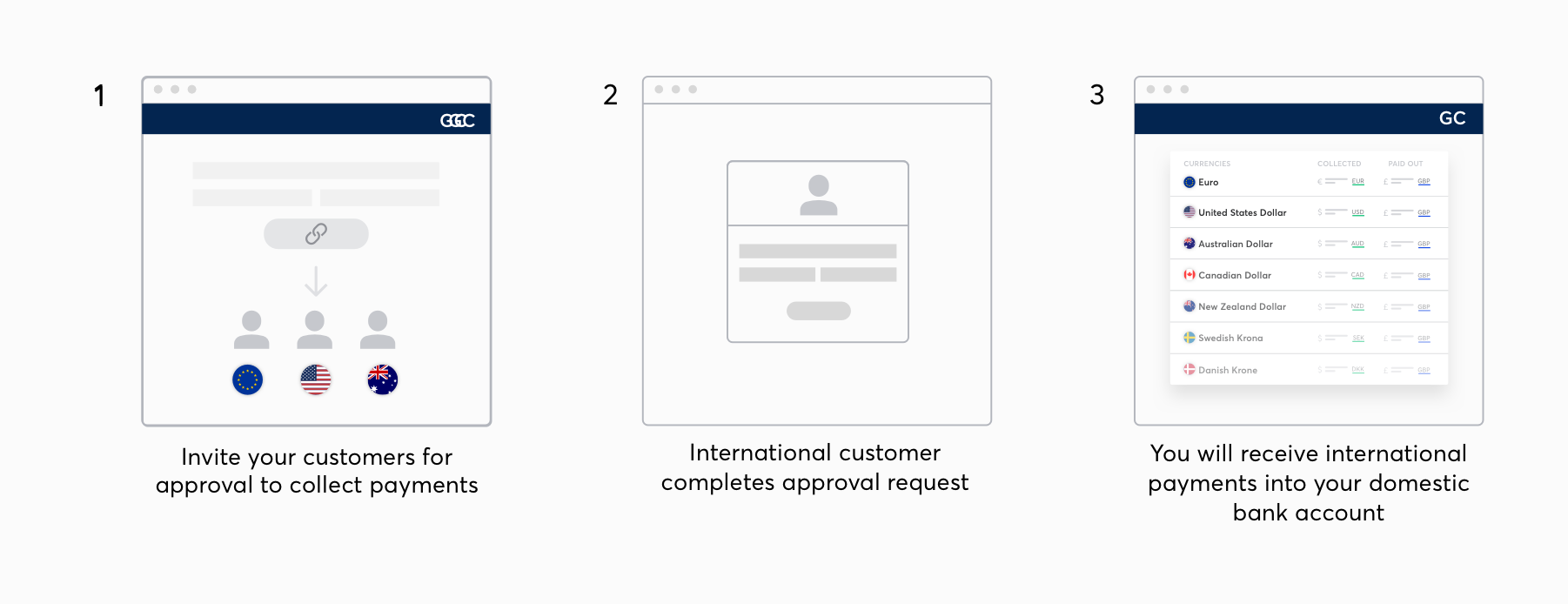

How to get started:

|

Alternative method: Receive international payments into locally registered payout bank accounts You can add an additional payout bank account in the same way you did when adding your first bank account. This is accessed via the GoCardless Onboarding flow. |

*Payments can be collected from customers located in the following countries

| Australia | Austria | Belgium |

| Canada | Cyprus | Denmark |

| Estonia | Finland | France |

| Germany | Greece | Ireland |

| Italy | Latvia | Lithuania |

| Luxembourg | Malta | Monaco |

| Netherlands | New Zealand | Portugal |

| San Marino | Slovakia | Slovenia |

| Spain | Sweden | United Kingdom |

| United States |

Payments can be collected from customers in the following countries providing they have a Euro-denominated bank account **

| Bulgaria | Croatia | Czech Republic |

| Hungary | Iceland | Liechtenstein |

| Norway | Poland | Romania |

| Switzerland |

** Please note : In order to collect EUR payments from customers in these countries, you must be on the Pro/Custom package with Custom Payment Pages enabled.

Helpful links