Xero has launched a new version of the GoCardless integration as of the 7th of April 2021.

If these guides do not reflect your experience please switch to the new support guide here

This article will explain how reconciliation works with GoCardless for Xero when your GoCardless account has international payments enabled.

To find out more information about international payments, take a look here.

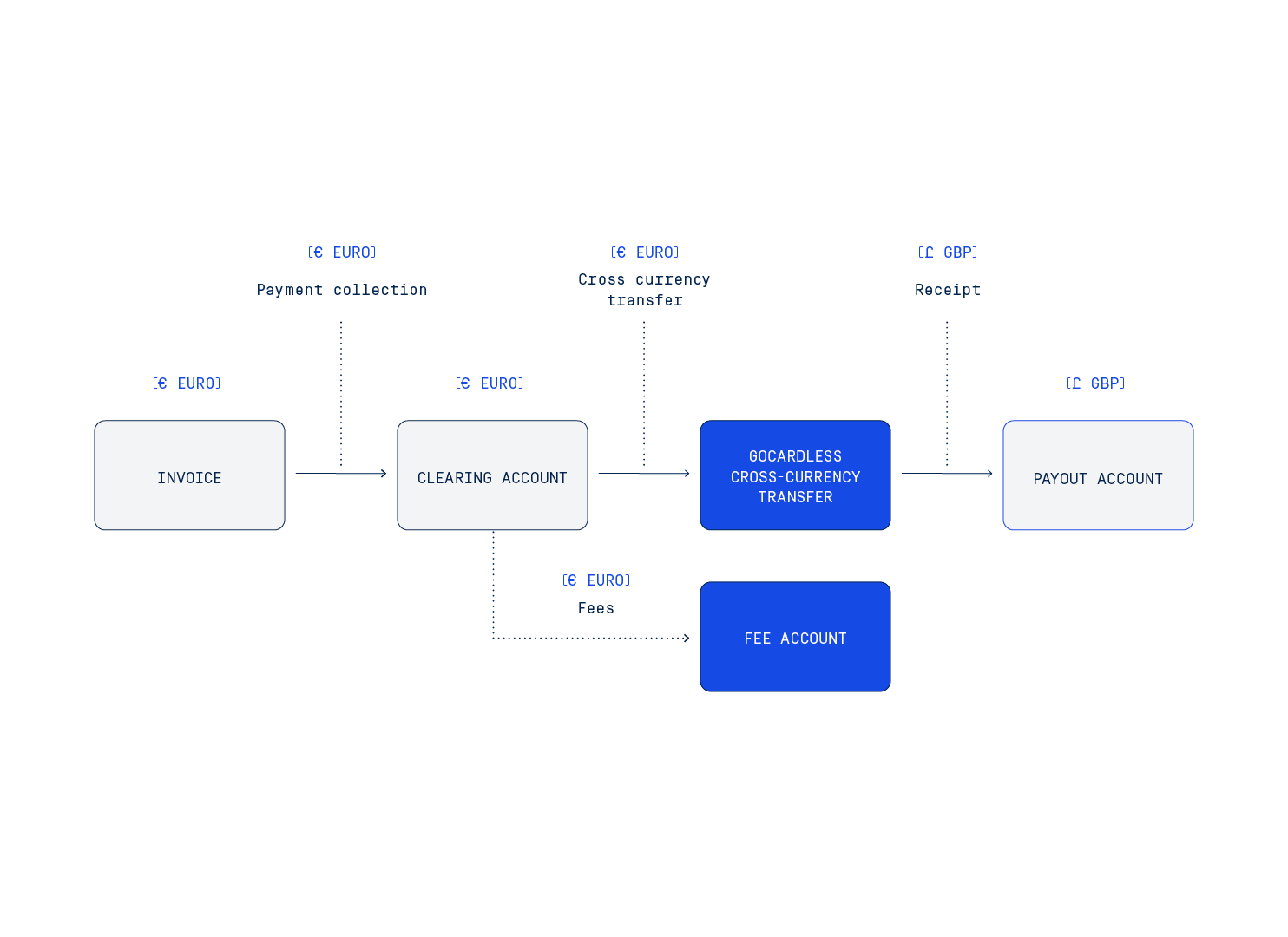

International payment collection means the payment will be collected in your customer's currency, and then converted to be paid out in your home currency. We need to reflect this currency conversion in Xero and this is handled within the Direct Debit interim account that is created for you within Xero.

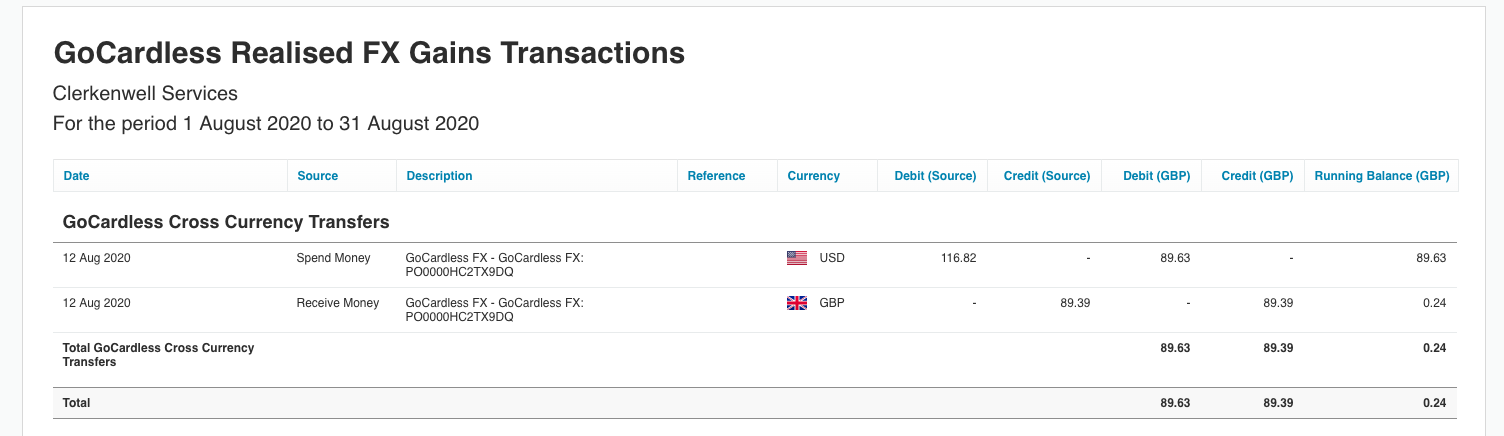

We'll use an example to show how collecting a foreign currency invoice will be reconciled:

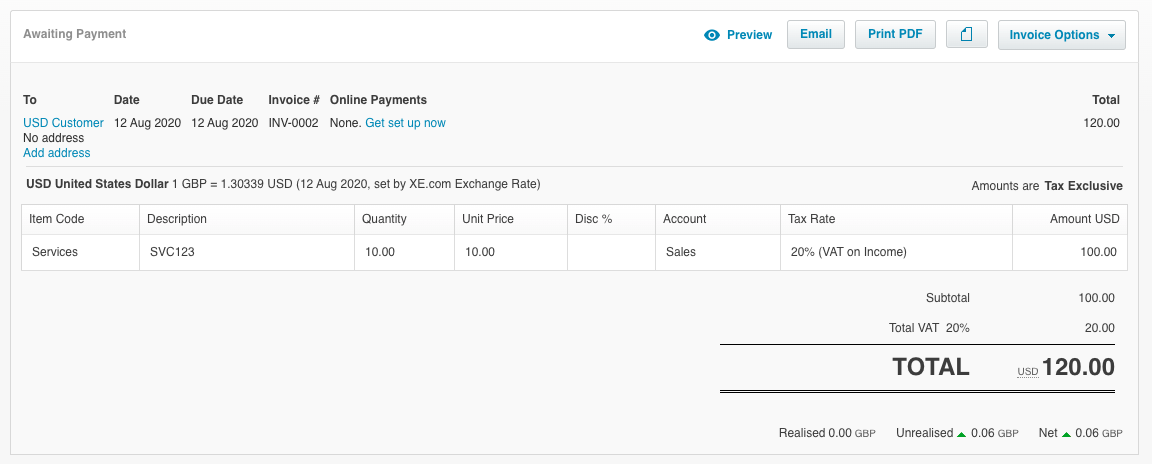

1). For this example, we'll assume that the business is based in the UK. We'll use an invoice that is in USD, being charged from a customer in the USA. The invoice is for $120 and the due date on the invoice is 2020-08-12.

2). On the due date of the invoice, the payment is collected from the customer's bank account by GoCardless. The invoice is marked as paid in Xero on this day, and this payment is paid into the USD Direct Debit interim account.

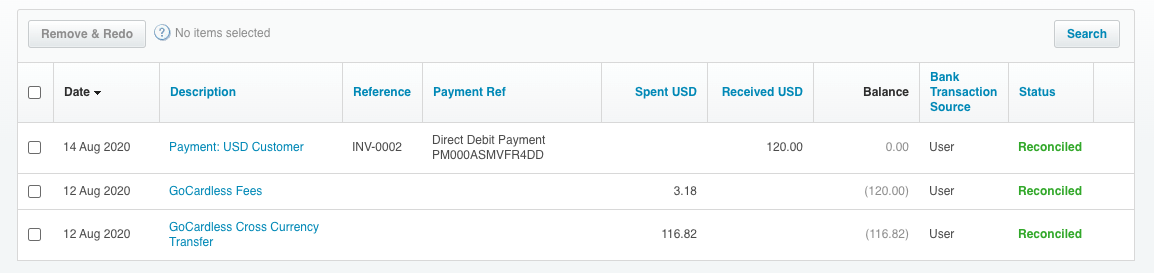

3). On the payout date, the funds are transferred by GoCardless to your bank account. Within Xero on this date, two transactions will show in the Direct Debit - USD account:

- A ‘SPEND’ transfer of the payout amount (net of fees) from your Direct Debit - USD account to GoCardless Cross-Currency Transfers (in our example, that would be the net payout of $116.82)

- A ‘SPEND’ transfer of the payout fees from the Direct Debit - USD account into your nominated fee account (in our example, that’s the fees which is $3.18)

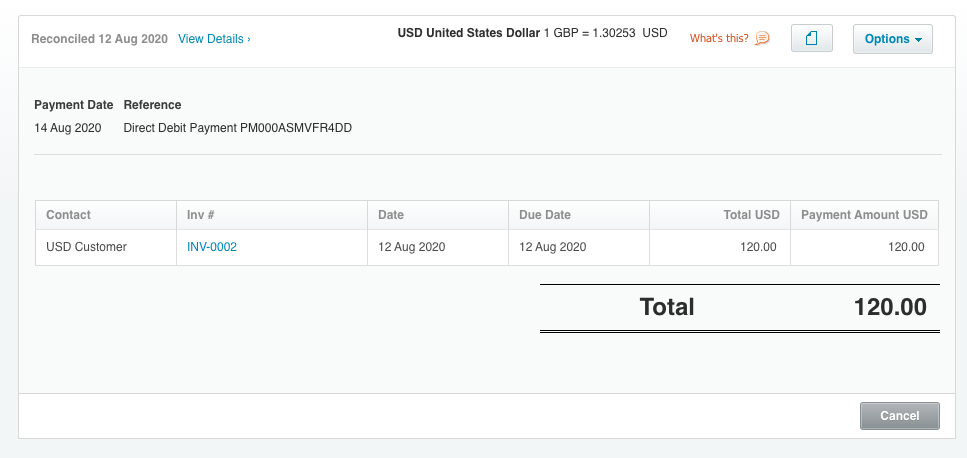

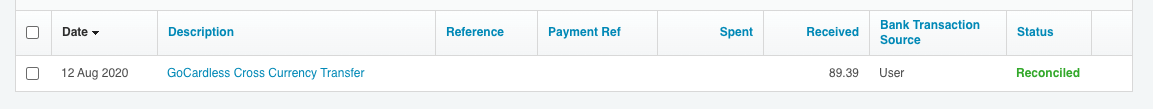

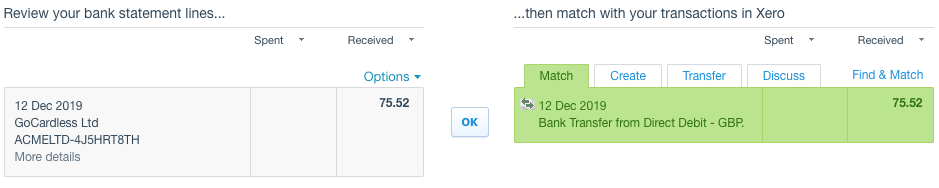

4). On your Current Account reconciliation page, once your bank feeds have imported, your receipt from GoCardless should auto match for reconciliation against the transaction we created from GoCardless Cross Currency Transfer. In our example, this is £89.39 (equivalent to the $116.82 above, using the GoCardless exchange rate).

*Please note this screenshot relates to a different transaction.

5). To view any realised gains or losses which are present due to the differences between the Xero exchange rates and GoCardless exchange rates, you can go to Accounting > Reports > Account Transactions. Search ‘GoCardless’ in the accounts list to find your Cross-Currency Transfers Account (If you aren’t sure which account this is, go to the Xero Reconciliation settings page in the GoCardless for Xero dashboard). You should then see money coming in in various currencies (in this case, USD) and going out in your GoCardless home currency (in this case GBP). The money left in this account will represent the realised FX gain / loss which you have incurred due to the difference between the Xero exchange rate and the GoCardless exchange rate.