Direct Debit is a widely used payment method across the globe. Different territories operate different schemes such as Bacs in the UK, SEPA across the Eurozone and BECS in Australia.

GoCardless provides a single point of access to a number of these Direct Debit schemes. The list can be found here.

By default, a GoCardless account will have access to the scheme associated with the country where you're signing up from e.g. if you're based in France, you're account will have SEPA enabled. If you wish to request access to another scheme supported by GoCardless, please send an email to help@gocardless.com.

Implementing a new scheme

As an integrator, it’s important to be aware of the fields that need to be addressed when adding another scheme to your integration.

The two most important fields to adjust are scheme and currency (please see the endpoint documentation for where parameters are required):

| Parameter values by Scheme | ||||||||

|---|---|---|---|---|---|---|---|---|

| API Endpoints | Parameter | Bacs | SEPA | Autogiro | BECS | Betalingsservice | BECS NZ | PAD |

| Redirect Flows | scheme |

bacs

|

sepa_core

|

autogiro

|

becs

|

betalingsservice

|

becs_nz

|

pad

|

| Mandates | ||||||||

| Creditors (scheme identifiers) | ||||||||

| Mandate PDFs | ||||||||

| Events | ||||||||

| Payments |

currency

|

GBP

|

EUR

|

SEK

|

AUD

|

DKK

|

NZD

|

CAD

|

| Payouts | ||||||||

| Refunds | ||||||||

| Subscriptions | ||||||||

| Customer Bank Accounts | ||||||||

Creating a customer using the Redirect Flow

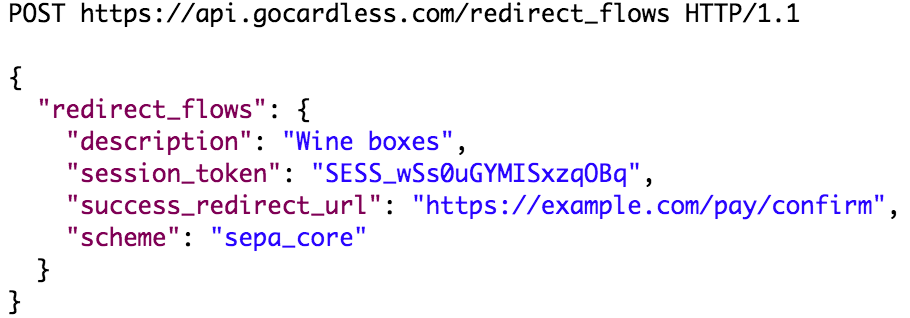

So for example when creating a customer based in a SEPA covered country via the Redirect Flow, you would simply change the scheme value:

Please note that the scheme value isn't a required field. If it isn't sent, the value will default to the scheme associated with the customer's bank account.

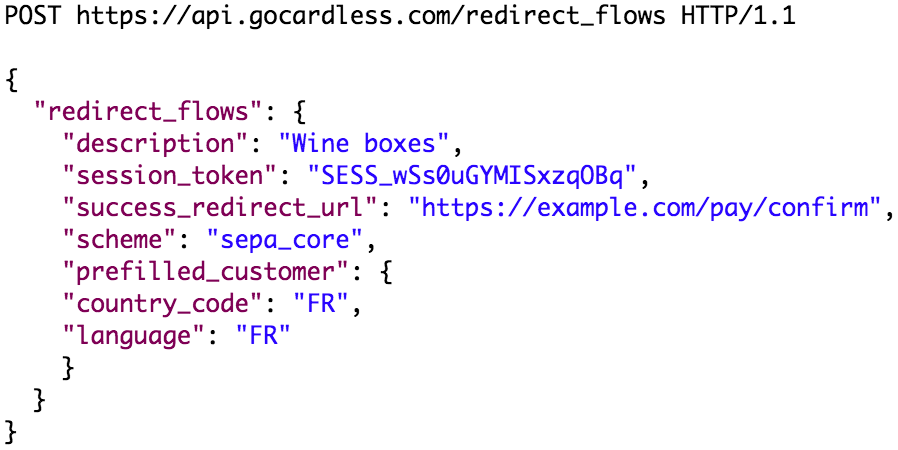

The language of the payment page will default to that of the customer's browser. However, you can also manually set the language of the payment page using the country_code and language parameters e.g.

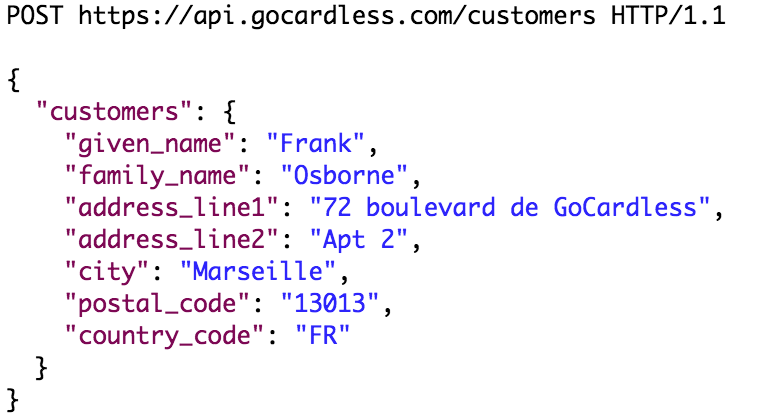

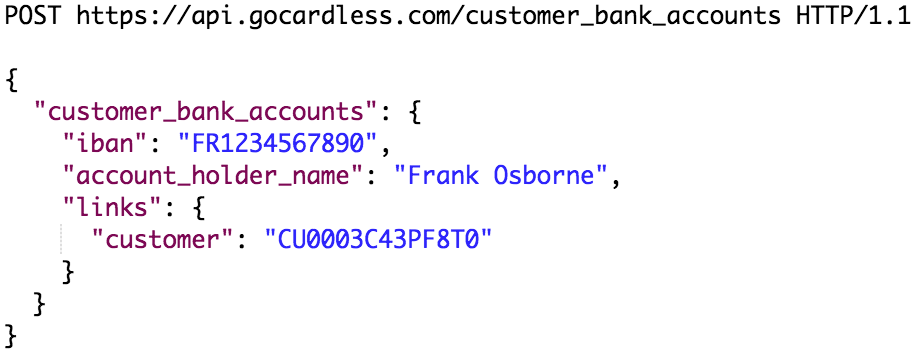

Creating a customer using Custom Payment Pages

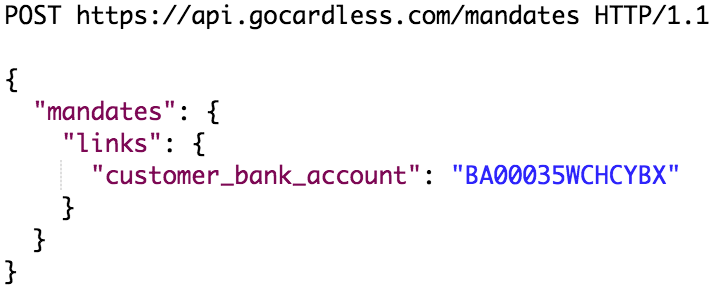

For integrators using custom payment pages on our Pro package, you would do something similar to the following to add a new SEPA customer:

Note that again the scheme isn't required when creating the mandate, as this will automatically be detected from the customer’s bank account.

Please note that in addition to the scheme and currency fields, when creating a Swedish Customer via the Redirect Flow or Customers endpoint, the following field is required:

- swedish_identity_number

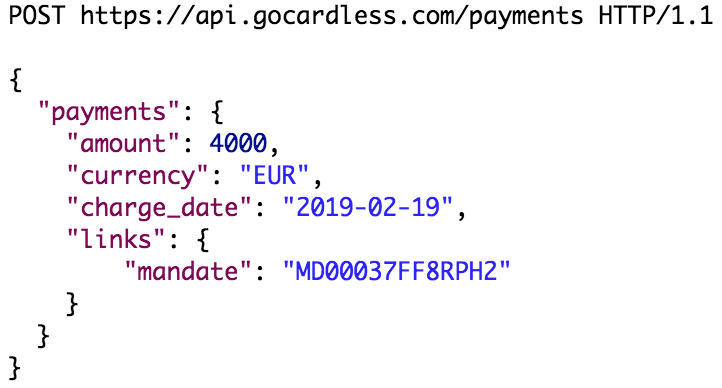

Creating a payment

To then create a payment after the customer is created, you’d do the following:

Additional information for partners

Checking the schemes a merchant has access to

As a partner using custom payment pages or the Redirect Flow, it’s important to know which schemes a merchant has access to before attempting to create a customer for a specific scheme. This can be found by using the Creditors endpoint to list the creditors on a GoCardless account (there should only be one creditor). You can then check the scheme_identifiers array, within which each instance will have a scheme field.

If a merchant doesn't have a scheme enabled on their account, they can make a request to add a new scheme by contacting help@gocardless.com. Additionally, if you're looking to test a new scheme in the sandbox environment, please send us an email to the above address and we can add any desired schemes.