Contents:

- The GoCardless Service

- Verification / Onboarding

- What types of businesses do you serve?

- Is there anything that I cannot use GoCardless to collect payments for?

- What information do I need to provide to get my account verified?

- We are a company - why do you need to collect a personal address?

- Are there any restrictions on the bank account I can use to receive payments?

- Who should I contact if I have any questions about the verification process?

- Using the GoCardless dashboard

- Connecting with a partner application

- Integrating with the API

The GoCardless Service

How long does it take to get set up?

A GoCardless account can be set up in just a couple of minutes. We'll ask you for a few details about your business during the online sign up flow before you're given access to your online dashboard. You're able to begin adding customers and creating payments for them immediately, however we won't be able to pay any collected funds out to you until you've completed the account verification process.

How long does it take for a payment to process?

Payments take 4-5 working days from submission to the bank for processing through to the funds being paid out to your account. Please see here for further details.

How often will I receive my payouts?

We process payouts on each business day, with funds being paid out two working days after the customer's charge date. We group funds by currency and so all payments due to be paid out to you in Australian Dollars on a given day will be paid in one lump sum. You can view a breakdown of payments making up each payout via the corresponding section of your online dashboard.

We charge a transaction fee of 1% capped at A$3.50 (minimum A$0.35) against each individual payment we successfully collect from your customers. We deduct this fee upon collection and then payout the remainder to you when due.

Which countries can I collect payments from?

Currently, Australian merchants will only be able to collect payments from customers in AUD through the BECS Direct Debit scheme if using an Australian based bank account to receive funds into. We hope to open up our other schemes to Australian merchants later in the year.

If, however, you have a bank account set up within the location of any of the other schemes you wish to use, (e.g. a bank account set up in the UK to collect payments through the Bacs (GBP) scheme), then you will be able to add additional schemes to your account during beta phase and collect payments from your customers in that respective region.

Is there a limit on the amount I can collect from a customer?

There is a default transaction limit for any payment collected through GoCardless. For payments collected in Australian Dollars, the limit is AU$10,000.

If you would like more information on our transaction limits, please see here.

Verification / Onboarding

What types of businesses do you serve?

We are able to provide our Direct Debit payment processing service to Sole Trader businesses and Proprietary Companies registered with The Australian Securities & Investments Commission (ASIC).

Is there anything that I cannot use GoCardless to collect payments for?

There are certain industries or use cases that we are unfortunately unable to serve.

These are listed in our Restricted Activities - we would recommend checking this list to make sure that GoCardless is suitable for your business before you begin to collect payments.

If you are unsure at all, please send an email outlining your business activities to verification@gocardless.com and we will get back to you with further advice.

What information do I need to provide to get my account verified?

This will vary slightly, depending on the legal entity of your business. You will always be asked to provide:

- Your business name

- A description of the nature of your business (please provide as much information as possible)

- Your support contact details and a link to your website

If you are operating as a sole trader you will also be asked to provide:

- Your name, residential address and date of birth

- Supporting identity documents (i.e. a copy of your photographic ID and a document as proof of residential address)

- A recent bank statement for your payout account, in order to verify the details.

- See here for more information about the supporting documents that we can accept

If you are operating as a Proprietary Company you will also be asked to provide:

- Your Company Number

- Your Company registration documents (ie a copy of your ASIC registry entry.)

- This will need to display your business name, address and the details of all officers and shareholders.

- The name, date of birth & residential address of a company director

- The names and dates of birth of all individuals who own or control more than 25% of shares or voting rights.

- A recent bank statement for your payout account, in order to verify the details.

Your GoCardless dashboard will guide you step by step through this process.

We are a company - why do you need to collect a personal address?

In line with our regulatory requirements, we must verify the identity of a registered company director.

Part of this includes verifying their home address - this information is used purely for verification purposes and will never be shared with your customers.

Are there any restrictions on the bank account can I use to receive payments?

In line with strict regulatory requirements, we must settle funds to a bank account held by and in the name of the legal entity that we are processing payments on behalf of.

- If you are operating as a Proprietary Company, the bank account will need to be held in your company name.

- If you are operating as a sole trader, you can use any account that is held by you as an individual.

Once you have connected your bank account, we will ask you to provide a statement that displays:

- The account holder name

- The account number

- A date within the past 6 months

This will be used to verify that we are placing funds into the correct account on your behalf.

Who should I contact if I have any questions about the verification process?

If you have any questions and cannot find the answer via our Support Centre, please email us at verification@gocardless.com.

Using the GoCardless dashboard

When adding a customer, you are inviting them to authorise a Direct Debit mandate with your business/organisation. Once this mandate is in place, you can create payments to collect from their account automatically.

There are three methods for adding customers, each with their own benefits. You can add an authorisation link on your website or invoice, invite them via email from your GoCardless dashboard, or add multiple customers in one go via our bulk upload tool (... Read more).

How do I create a one-off payment?

If your customer has an active Direct Debit mandate, you can create a one-off payment for them via your dashboard (... Read more). You can also create one-off payments for multiple customers in one go via our bulk payment import tool (... Read more).

For new (inactive) customers, you could send them a Paylink, which would automatically create a one-off payment to be collected once their Direct Debit mandate has been set up (... Read more). This is particularly useful for collecting sign-up fees from new customers.

How do I create a recurring subscription?

A customer can be set up on a recurring payment plan by either creating a subscription for them individually (... Read more), or by assigning them to an active Plan.

Plans are a great way to save time when wanting to create the same subscription for multiple customers. You can either create the Plan and then add it to your customers' accounts individually as required (... Read more), or invite new customers to authorise their Direct Debit via a Plan link that automatically adds that payment plan to their account upon authorisation (... Read more).

How do I cancel a payment once it's been created?

A payment can be cancelled once it's been created, but only prior to the point it's submitted to the banking system for processing, which happens at 4pm, one working day before the charge date. Payments that can be cancelled will be in a "pending submission" status.

The cancellation can be performed from the respective individual payment details page in your dashboard (... Read more).

How do I change the charge date of a customer's subscription?

It's not possible to amend the charge date set for a subscription or plan. Instead you would need to cancel the existing subscription on the customer's account and then create a new one or add them to a new plan.

For plans where you want to update the charge date for all customers assigned to it, you would need to recreate the plan with your preferred charge date and then re-assign your customers to that plan. You can cancel the previous plan itself to remove all customers from it to ensure they're not charged twice. (Note: Your customers will receive a notification email informing them of each action).

Please note that in both cases your customer(s) would not need to authorise a new Direct Debit mandate.

Connecting with a partner application

What is a partner integration?

Partner integrations enable merchants to utilise the GoCardless payment service directly from within a third party application. The ‘partner’ integrates our API into their software or platform to enable payment requests to be processed through GoCardless, without the need for the user to login directly to the GoCardless dashboard.

Partner applications are a great alternative to the GoCardless dashboard as they can provide a bespoke experience according to the business type or industry they are addressing. Examples of our current partners include accountancy platforms, gym membership softwares, subscription services, window cleaning management, and more.

You can find out more about available partner applications here.

Do I have to use a pre-built integration?

Not at all. You may find that our online dashboard serves your needs perfectly well, or equally, you may decide that you’d prefer to integrate our API with your own in-house system(s) yourself. In many cases though, the simple set-up and bespoke experience of a partner application offers the ideal solution.

How can I find the right integration for me?

The best integration for you will depend on your requirements, along with your business size, type, and/or service you’re offering. You can find a list of available partner integrations here. You can click on those you’re interested in to find out more information about them, as well as how to connect your GoCardless account.

If you need further help on finding the right integration for you, please contact us directly at help@gocardless.com.

How do I charge my customers through an integration?

The process as to how you create payments will differ for each integration, but in all cases the payments/invoices would be created within that application. If you require further information on how to use your chosen integration, please contact the company directly.

Once you create a payment in your integration, the instruction to take the payment from the customer’s account will process automatically through GoCardless to ensure it is charged on the date specified. Please note that if you create a payment via a partner application and through your GoCardless dashboard, payment will be taken from the customer twice.

Who should I contact if I have questions about a particular integration?

Partners use our API to integrate the GoCardless payment service into their applications. As such, for queries specific to the partner application, we recommend contacting their support team if you require assistance. Our GoCardless Support team is always here to help should you have any queries regarding your payments.

Integrating with the API

First of all, you’ll want to create a sandbox account, you can do so here. You’ll then want to create an access token so you can make requests to the API.

We have a full getting started guide for the API here, which will walk you through making your first request, adding your first customer, and taking your first payment.

If you want to use webhooks, you’ll need to create a webhook endpoint and check out our guide on building a webhook handler here.

A useful testing tool is Scenario Simulators. They allow you to check that your integration handles common paths successfully, by triggering all of the Events in the scenario almost instantly. For example, a customer with the given name ‘Successful’ will have their mandate and payment succeed immediately. You can find the full list of simulators here.

How do I add customers through the API?

To add a customer, a Direct Debit mandate must be set up. A mandate is an authorisation from a customer to take payments from their bank account - once you have a mandate set up, you can charge the customer with future API calls. (A customer can have multiple mandates, but you’ll almost always only want one.)

When setting up a mandate, your setup process (e.g. a set of payment screens on a screen or a paper form) must comply with Direct Debit scheme rules. To make this easy for you, GoCardless hosts secure and fully-compliant payment pages that have been translated into many European languages.

The Redirect Flow API lets you use these hosted payment pages on all of our available packages. Once your customer enters their bank details, you will be set up with everything you need at once: a customer, a customer bank account, and a mandate.

You can find a more in depth guide to adding customers using the Redirect Flow here. Alternatively, if you’re creating your own white-label payment pages on our Pro package, please refer to this guide.

How do I set up a recurring payment through the API?

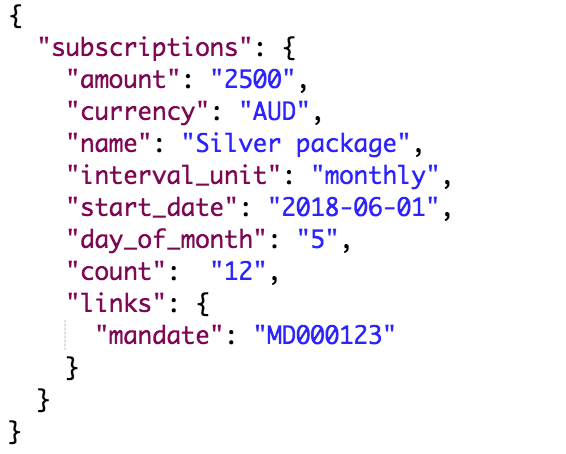

To set up a recurring payment through the API, you’ll need to make a POST request to the Subscriptions endpoint.

You can customise the following parameters when creating a subscription;

- Amount - the amount needs to be sent in pence, or cents, and cannot contain any special characters

- Currency - currently GBP, EUR, SEK and AUD are supported.

- Name - Optional name for the subscription, which will also set the description of each payment.

- Interval_unit - the unit of time between charge dates, either weekly, monthly or yearly.

- Interval - the number of interval_units between each charge date. This must result in at least one charge per year, and will default to 1 if not provided.

- Count - the total number of payments to be taken by the subscription.

- Day_of_month - the day of the month (1-28) you’d like your customer to be charged on. You can also use -1 to indicate the last day of the month.

- Month - the name of the month in which to charge a customer.

- Start_date - the date on which the first payment should be charged. This date must be within a year of the subscription being created, and on or after the mandate’s next_possible_charge_date. If this parameter isn’t included, the first payment will be charged as soon as possible.

- Payment_reference - This parameter is restricted to Pro accounts only. An optional payment reference that will be set for all payments and will appear on your customer’s bank statement.

For example, to create a subscription that charges...

- A$25

- on 5th of each month

- starting from 01/06/2018

- for 12 months

... you'd need send the following POST request to the /subscriptions endpoint, linking the mandate ID you wish to charge:

How do I stay up to date with events in my GoCardless account?

A webhook is a request that GoCardless sends to your server to alert you of an Event. Adding support for webhooks allows you to receive real-time notifications from GoCardless when things happen in your account, so you can take automated actions in response, for example:

- When a payment fails due to lack of funds, retry it automatically

- When a customer cancels their mandate with the bank, suspend their account

- When a customer’s subscription generates a new payment, record that payment against their account

For a more in depth look into getting started with webhooks, please refer to our guide here.

Where can I find more information about building an integration?

We have a full API reference here, and you can find the Developer section of our Support Centre here.

If you have any questions that aren’t covered by the above, please email the Developer Support team at api@gocardless.com.